California has stark variations in senior well being care in relation to its northern and southern counties.

Throughout the nation, Medicare Benefit has grow to be more and more common amongst Medicare beneficiaries.

The privatized model of Medicare usually sees insurers supply decrease premiums, with imaginative and prescient and dental protection added on. Altogether, greater than 50 % of eligible Medicare recipients are on the personal plans, however a brand new report from well being coverage analysis agency KFF discovered drastic variations between Medicare Benefit enrollment in California areas.

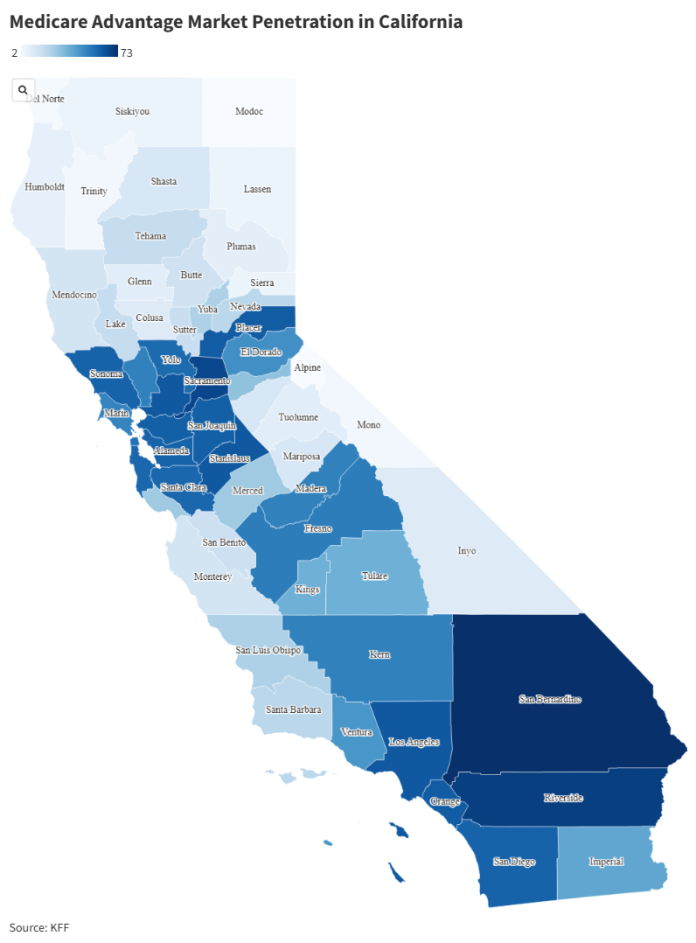

The market penetration for Medicare Benefit was considerably decrease in northern nations, whereas the southern components of California usually noticed enrollment charges above 55 %, information from the Facilities for Medicare & Medicaid Providers confirmed.

California differed from different populous states, corresponding to Florida, which noticed considerably constant percentages of Medicare-eligible residents on personal plans.

Alex Beene, a monetary literacy teacher on the College of Tennessee at Martin, stated California, particularly its northern area, has lagged behind different states in getting residents to submit all of the documentation wanted to register for these kind of packages previous to deadlines.

“So many residents grew accustomed to having providers both obtainable totally for utility on-line or prolonged with no paperwork required throughout the pandemic years and are failing to regulate to the brand new actuality as rapidly as many hoped they might,” Beene instructed Newsweek.

Medicare Benefit additionally sometimes struggles with its word-of-mouth promoting to those that aren’t but members, Beene added.

Smith Assortment/Gado/Getty Pictures

“California has had a number of conditions of well being care suppliers who failed to come back to phrases with Medicare Benefit and had been subsequently dropped from these plans,” Beene stated. “When you will have a couple of conditions like that, it is easy to see why some annoyed recipients would discourage these they know from becoming a member of.”

Greater than a 3rd of Medicare beneficiaries dwell in a county the place no less than 60 % of all Medicare beneficiaries are enrolled in Benefit plans, KFF discovered. So on a large scale, Medicare Benefit stays common, however sure counties are sometimes incentivized to stay with conventional Medicare.

“The vast variation in county enrollment charges replicate a number of elements, corresponding to variations in agency technique, urbanicity of the county, Medicare fee charges, variety of Medicare beneficiaries, well being care use patterns, and historic Medicare Benefit market penetration,” KFF stated in its report.

Medicare Benefit beneficiaries made up greater than half of all enrollees in 30 states, and 7 states noticed 60 % or extra of their Medicare recipients on privatized plans.

Sometimes, the counties that noticed decrease enrollment had been rural, whereas city areas noticed a better proportion choose into the privatized model of Medicare.

A part of this can be because of the restricted networks folks on Benefit plans usually need to take care of, and in rural areas, there might be a decrease variety of well being care suppliers who settle for a particular Medicare Benefit plan.

There are different notable cons in some circumstances to taking over a Medicare Benefit plan. Many insurer plans require medical doctors and hospitals to get approval for remedies in a “prior authorization” request, which might take weeks and even months.

“Medicare Benefit plans declare to make use of prior authorizations to handle prices and cut back pointless medical providers,” Smile Insurance coverage CEO Chris Fong instructed Newsweek. “Nevertheless, prior authorizations are considered by many medical suppliers and sufferers as an pointless barrier to care.”

KFF additionally discovered that the variety of prior authorization requests denied by Medicare Benefit grew between 2021 and 2022, from 5.8 to 7.4 %. Altogether, KFF stated, 3.4 million prior authorization requests had been denied.