Speaking about cash with pals and acquaintances might seem to be a fake pas, but when there’s any time to tear down that stigma, it’s now. For a lot of, the results of life amid the COVID-19 pandemic have been financially damaging, making budgeting for wholesome habits troublesome, if not virtually not possible. That’s the place Properly+Good’s Checks+Balanced collection is available in. Consider it as an area to encourage extra open and frank conversations round cash—particularly concerning how completely different individuals are capable of afford the wellness habits which can be necessary to them.

For Danielle, paying off pupil mortgage debt is tough sufficient to finances for, however in including in the necessity to save for her upcoming wedding ceremony, monitoring bills grew to become much more necessary to her. It is a main purpose why she—a publicist dwelling in Boulder, Colorado—determined to maintain her bartending job years after graduating school. Having the additional cash are available in makes getting that month-to-month mortgage cost slightly simpler to face.

The additional revenue additionally helps Danielle finances for the wholesome habits that assist her really feel like her greatest self. She has rheumatoid arthritis and says she’s seen a correlation between the kinds of meals she eats and the way bodily energetic she is to the severity of her signs. Right here, Danielle explains precisely how she makes all of it work.

Preserve studying to see how Danielle balances budgeting for her favourite wholesome habits and her upcoming wedding ceremony whereas prioritizing paying off her pupil loans.

*Danielle, 24, publicist and bartender, Boulder, Colorado

Earnings: $65,400/yr. I graduated school in 2018 and work in public relations, making $55,000 a yr. Loads of my shoppers are wholesome meals manufacturers—there are such a lot of primarily based proper right here in Boulder! Along with my full-time job, I work as a bartender one evening per week for more money at a neighborhood restaurant. I make about $200 per week bartending. I really began working on the restaurant after I was 16 as a number and server, so I have been working right here a very long time.

The pandemic has modified the restaurant business, and lots of of my colleagues have been severely affected. Our restaurant closed down totally when COVID-19 started to unfold broadly, and we started solely providing curbside takeout. We have accomplished a selected state certification to adjust to COVID-19 restrictions, that means we’re now allowed to have some friends within the restaurant. That stated, we nonetheless advocate takeout ordering, and all friends who do dine in should wait of their automotive earlier than being seated to keep away from coming in shut contact with every others at the moment consuming at or leaving the restaurant.

My restaurant has been lucky that the local people has actually supported the enterprise. Since I solely work as soon as per week, my revenue from the restaurant hasn’t modified a lot, however a lot of my pals [who rely on service-industry jobs more heavily] have misplaced some huge cash throughout the pandemic. Finally, I am trying ahead to the day when can all eat collectively safely once more.

Housing: $800/month. I stay in a one-bedroom condo with my fiancé, and we break up our hire proper down the center, totaling at $800 a month every. We really break up all just about our payments down the center like that.

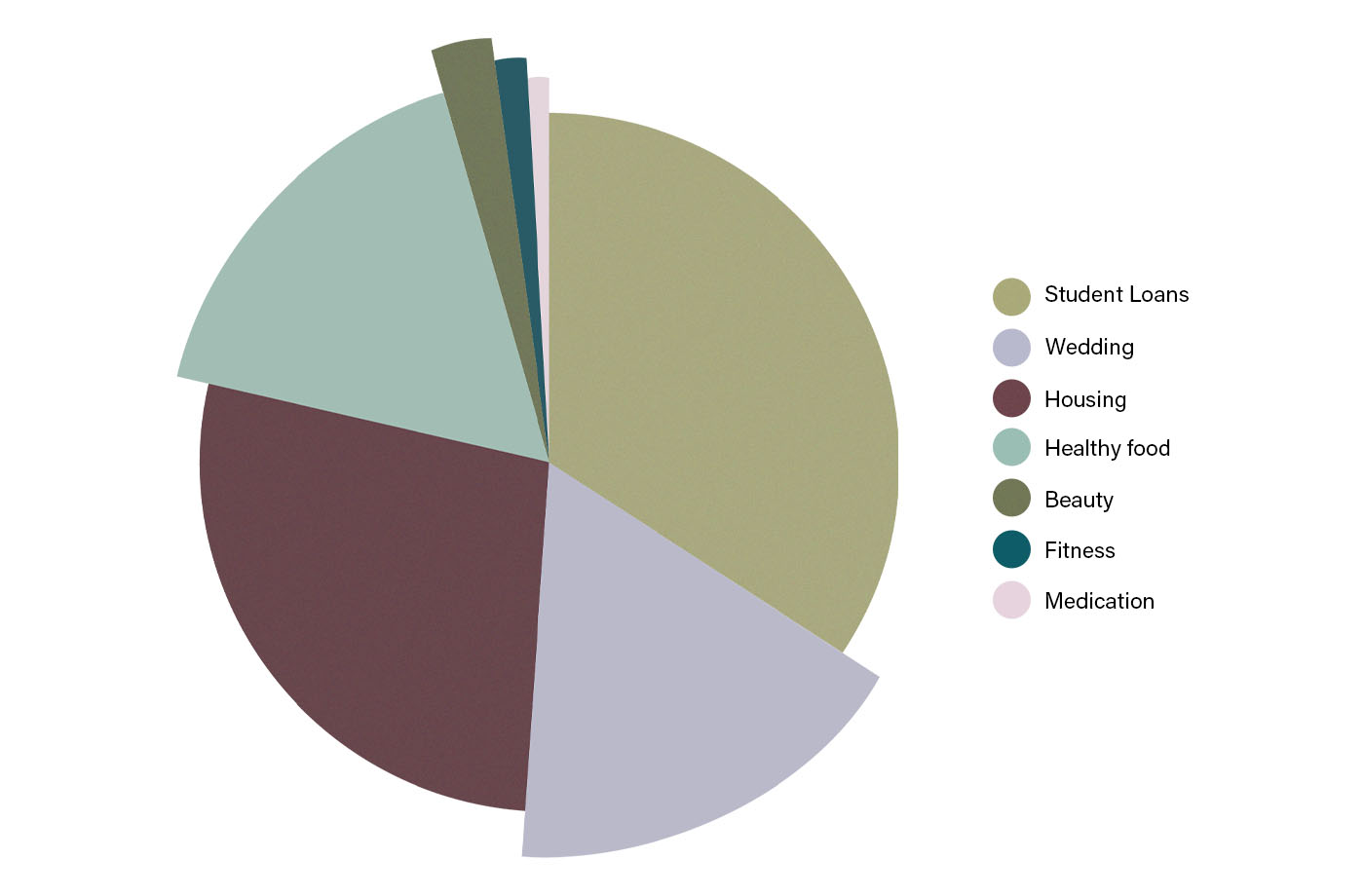

Different recurring bills: $1,680/month. I simply acquired engaged, so my fiancé and I are each saving for our wedding ceremony, which we hope to have the ability to safely have subsequent yr. We each contribute $500 a month to our wedding ceremony fund. Moreover the marriage, one in all my greatest bills is paying off my pupil loans. I pay $1,000 a month towards them—which is greater than I spend on anything.

My fiancé and I additionally purchased a pandemic pet, slightly Labrador combine. Between meals and toys, I spend about $100 a month on the canine. My solely different recurring bills are Wi-Fi and utilities, every $40 monthly for my half. I removed my automotive throughout the pandemic, so I haven’t got any transportation prices (Boulder is de facto walkable). I additionally use my dad and mom’ Netflix account, which I do not pay for.

Wholesome meals: $500/month. I do not comply with a selected eating regimen, per se, however I do have rheumatoid arthritis, and I’ve discovered that after I do not eat meals which can be extremely processed or have lots of sugar, my signs aren’t as extreme. I attempt to eat on the more healthy aspect, and I do most of my grocery buying at Dealer Joe’s spending about $100 per week. I purchase a lot of greens, fruits, and packaged meals made with entire meals elements. My fiancé works at a restaurant and eats lots of his meals at work, so I undoubtedly purchase extra groceries than he does. We additionally order takeout about as soon as per week, which prices about $25 every.

Health: $21/month. Boulder is certainly a really energetic place to stay, and I prefer to make the most of that by going for hikes or runs when the climate is good. My new canine makes certain I get loads of time outdoors, too. The one fitness-related exercise that I pay for is a $21 month-to-month subscription to Obé Health, which is a digital platform that has an entire bunch of several types of health courses, providing each stay and on-demand courses.

Magnificence: $960/yr. I spend about $50 a month on skin-care merchandise and attempt to prioritize shopping for merchandise which can be all-natural. The one magnificence behavior I do prioritize is getting facials a few instances a yr, which is $100 every time. To me, it is simply as a lot of a self-care second as it’s a magnificence one. I additionally get my nails accomplished about 4 instances a yr, which is $40 every time.

Medicine: $260/yr. I take a prescription remedy for my arthritis. My insurance coverage pays for a few of it, nevertheless it prices $65 every quarter out of pocket.

My greatest cash objectives proper now are paying off pupil loans and budgeting for my wedding ceremony, however shopping for meals that will not trigger arthritis flare-ups and discovering inexpensive methods to remain energetic will all the time be a precedence to me. I am grateful to have a second job that helps make budgeting slightly simpler than it could be in any other case. It is undoubtedly value the additional work!

*Final title has been withheld.

Need to be featured? Electronic mail [email protected].

Oh hello! You appear like somebody who loves free exercises, reductions for cult-fave wellness manufacturers, and unique Properly+Good content material. Join Properly+, our on-line neighborhood of wellness insiders, and unlock your rewards immediately.

Our editors independently choose these merchandise. Making a purchase order by our hyperlinks might earn Properly+Good a fee.