How does Experian Increase work?

To get began, you’ll join a free account with Experian® utilizing your SSN and private info. Experian protects your knowledge with 256-bit SSL encryption. You could be prompted to hyperlink a fee methodology and join a paid account, however you don’t have to.

To qualify to make use of Experian Increase, you want not less than six months of credit score historical past and not less than one account that has been reported to the credit score bureaus. As soon as your Experian account is ready up, you’ll navigate to the “Credit score” web page from the dashboard and choose the “Experian Increase” device.

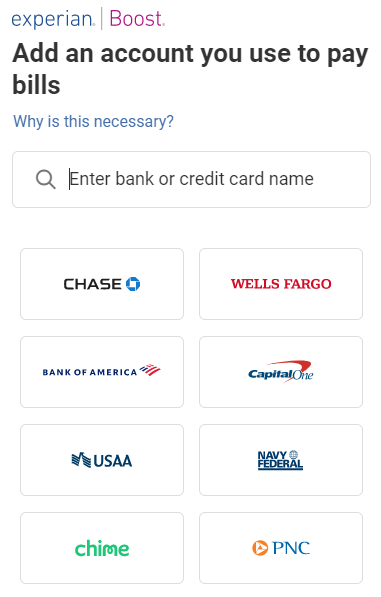

Subsequent, you’ll hyperlink the financial institution accounts or bank cards you utilize to pay most of your payments. This can require you to authenticate your accounts by signing in and authorizing Experian to entry your info.

If you happen to can’t hyperlink your financial institution, Experian Increase in all probability doesn’t assist it and also you’ll have to strive an alternative choice. You’ll be able to add and take away accounts at any time.

After connecting your financial institution, you can begin your enhance. Experian will take a few minutes to scan for eligible payments.

When your enhance is completed, you’ll manually choose which payments you need to add to your Experian credit score report of those discovered. It might be a good suggestion to decide on those scheduled to be paid robotically. Every invoice wants not less than three funds over a span of six months to rely with a type of funds being from the final three months.

You’ll be able to report the entire following varieties of payments:

- Telephone plans (together with Verizon, AT&T, and T Cell)

- Web, cable, and satellite tv for pc

- Streaming (together with Hulu, HBO, Netflix, and Disney+)

- Energy and photo voltaic

- Gasoline, electrical energy, and water

- Trash

This device may even provide you with credit score for residential lease funds when you make them by a supported on-line fee platform. If you happen to pay lease with a test every month, you gained’t be capable of have it counted in your credit score report.

If you happen to see a invoice you don’t need to add, click on “Take away.” Then, confirm that each one different payments are correct.

After boosting, your rating might or might not enhance instantly. In case your credit score rating doesn’t enhance straight away, it doesn’t imply it’s not going to. Experian will test your account month-to-month for invoice funds and replace your account. However outcomes are not assured. Word that Experian makes use of FICO Rating 8.

Experian Increase Disclaimer – Outcomes might range. Some might not see improved scores or approval odds. Not all lenders use Experian credit score information, and never all lenders use scores impacted by Experian Increase.

Pricing for Experian Increase

By itself, the Increase characteristic is free to make use of. And there are various different free assets that include an Experian account together with credit score rating monitoring and monitoring.

You’ll be able to pay to improve to a premium account and unlock much more instruments in addition to entry to your FICO scores for mortgages, auto loans, and bank cards, however this isn’t essential for utilizing Increase.

Experian Increase options

Listed here are the important thing options and advantages that include utilizing Experian Increase.

FICO® rating 8 monitoring

Experian makes use of FICO Rating 8 for Increase. The overwhelming majority of lenders are concerned about FICO credit score scores and FICO Rating 8 could be very generally used to guage creditworthiness everytime you apply for credit score.

However lenders get to determine which credit score scores to make use of and should select not to have a look at your Experian credit score report in any respect. Do not forget that Experian is only one of three main credit score bureaus. The opposite two, TransUnion and Equifax, additionally calculate your credit score rating however might provide you with barely completely different outcomes based mostly on which FICO rating fashions they use and which knowledge factors they collect.

Many lenders reminiscent of mortgage lenders will pull your credit score report from all three credit score bureaus. However there’s additionally an opportunity {that a} lender gained’t find yourself taking a look at your Experian credit score rating in any respect when evaluating your credit score file.

Customizable reporting

Experian Increase offers you the chance to make your on-time invoice funds work in your favor after they usually wouldn’t. Noncredit payments like utilities and lease normally don’t get reported as a result of they don’t rely as credit score, however this device permits you to construct your historical past extra rapidly by including a few of these funds.

And also you get to decide on what counts and what doesn’t. You choose a checking account or bank card you’re snug linking and add the payments you already know will work greatest for you, reminiscent of these with extra funds and people you’re most probably to pay on time.

Optimistic fee historical past

When you’ve got any late funds in your checking account, Experian Increase won’t report these. Experian Increase solely pulls info that may assist, not hurt, your FICO® Rating. It is going to skip knowledge that will rely towards you and also you’ll additionally be capable of take away fee historical past you don’t need to be tracked.

Which means there isn’t a threat of wounding your rating utilizing Experian Increase. Though you may not see a change for the higher, you additionally gained’t see a change for the worst. That mentioned, extra funds can have a bigger impression in your credit score long-term, so that you need to ensure you’re paying your payments on time every time doable.

Learn extra: How you can pay your payments when you don’t have any cash

Who’s Experian Increase superb for?

Listed here are a couple of individuals we are able to see benefitting from Experian Increase.

Folks with restricted credit score historical past

Experian Increase is designed for “thin-file” clients or these with little credit score historical past. Including on-time funds to your report can reveal that you simply’re accountable together with your cash, making it simpler to borrow sooner or later.

Simply keep in mind that you want a credit score historical past not less than six months outdated to qualify to enroll.

Individuals who want a small credit score enhance

Utility funds may solely increase your rating by a couple of factors. Typically, although, these few factors are all you’ll want to fall right into a extra favorable bracket for a lender.

Folks working to enhance their credit score

The decrease your credit score rating is, the extra possible you’re to see enchancment utilizing Experian. The change may not be important, however any optimistic motion is a step in the best path.

Who isn’t Experian Increase good for?

This device might not be a superb match for the next individuals.

Folks with late funds or few utility payments

If for one cause or one other you don’t have many utility payments to pay otherwise you are likely to make your funds late, Experian Increase is unlikely that can assist you out. The extra on-time invoice funds you’ve, the higher.

Folks with no credit score

If you happen to’re model new to credit score, maintain off on utilizing Experian to enhance your rating till you may present six months or extra of credit score. Increase isn’t designed for constructing credit score from scratch.

Folks making use of for dwelling loans

Most mortgage lenders use a model of the FICO® rating that isn’t affected by Experian Increase. So if you wish to up your credit score particularly to get a house mortgage, Increase isn’t the only option.

Learn extra: How you can get authorized on your first mortgage

Experian Increase vs. credit score restore

If you happen to’re studying this and questioning how Experian Increase differs from credit score restore, let’s make clear.

Credit score restore can imply a few issues. First, it may imply doing the work your self to repair your credit score. We’ll speak extra about this within the subsequent part, however principally any steps you are taking to enhance your rating reminiscent of repaying a few of your debt, getting management of your spending, and avoiding borrowing an excessive amount of can rely as credit score restore and work in your favor. When your credit score is in unhealthy form and you’re employed to alter that, that’s credit score restore.

One other model of credit score restore is a service you pay for. Corporations providing credit score restore declare to have the ability to enhance your credit score for you. They do that by getting inaccuracies eliminated out of your credit score historical past and disputing errors or errors that could possibly be bringing your rating down. Credit score restore corporations work in your behalf to “clear up” your credit score report by speaking to the bureaus, however they’ll’t assure enchancment or do something you couldn’t do your self.

If anybody tries to let you know that you’ll want to pay to repair your credit score, stroll away (or hold up, or no matter). We do not advocate paying for credit score restore providers.

Experian Increase can fall into your personal credit score restore technique, however this device isn’t the identical as a paid credit score restore service even when you pay to improve your Experian account.

Are there different straightforward methods to construct or rebuild your credit score?

There are a selection of issues you are able to do proper now to begin constructing or repairing your credit score. Listed here are just some.

Get a secured bank card – Secured bank cards have greater acceptance charges than conventional unsecured bank cards. They require a refundable money deposit as collateral however in any other case operate like a traditional bank card. You’ll repay your invoice every assertion interval and your fee exercise might be reported to the bureaus and have an effect on your credit score (for higher or worse).

Apply for a credit score builder mortgage – Credit score builder loans are designed to enhance your credit score with common optimistic funds. You’re taking out a mortgage and make month-to-month repayments with curiosity. This is usually a good possibility for brand spanking new debtors and people with delinquencies.

Grow to be a licensed consumer on another person’s card – A dad or mum, partner, or shut pal can add you as a consumer to certainly one of their bank cards, permitting you to spend on their account. This could add optimistic fee historical past to your credit score so long as they pay their invoice on time and doesn’t require you to qualify – however asking to be a licensed consumer on somebody’s card is an enormous deal.

Abstract

For individuals who need credit score for his or her on-time invoice funds, Experian Increase is price testing. This device might not instantly enhance your rating or enhance it in any respect, nevertheless it’s not going to harm it or value you something.

If you happen to’re not snug linking a checking account or bank card, think about different choices.