How does Side Wealth work?

Side Wealth begins by first attending to know your private state of affairs, then pointing you in the proper route.

Side Wealth begins the method with an preliminary telephone name. It lasts for about half an hour and is a goal-setting and introductory telephone name. There’s nothing you must do to organize for it.

Utilizing your info, Side Wealth can set you up with one in all their CFP®s for an preliminary complimentary monetary evaluation. This half takes lower than an hour.

After the evaluation, you may rent this firm on an ongoing foundation. They’ve a wide range of plans based mostly in your wants. And when you’re a consumer, you may meet together with your CFP® every time you must and may ask no matter questions you might have.

Notice that your questions could also be restricted to the matters you pay for recommendation on. As an example, when you don’t select a plan degree that features property planning, you received’t be capable of ask property planning questions.

Side Wealth providers

Side Wealth goes past the straightforward funding administration offered by robo-advisors.

They supply funding administration and complete monetary planning providers, which can embrace the next:

Retirement planning: Your CFP® at Side Wealth will put collectively an motion plan that will help you attain your retirement targets, in addition to aid you to know the methods behind it.

Schooling planning: You probably have youngsters, Side Wealth presents choices to pay for his or her future training.

Life planning: Your advisor will aid you to plan for what’s most necessary in your life.

Asset administration: That is the funding administration a part of the Side Wealth program. It would embrace developing a well-diversified portfolio that will help you obtain your long-term targets.

Revenue tax planning: This service entails minimizing the influence of taxes whereas implementing your monetary plan and investing actions.

Insurance coverage planning: Should you don’t know an entire lot about insurance coverage, your monetary advisor at Side Wealth may help. They’ll suggest the most effective kinds of plans to offer particular protections you want for your self and your loved ones.

Property planning: Side Wealth will work together with your private lawyer to create an property plan to offer in your family members after your dying.

Legacy planning: This entails making a plan to make provisions for both your loved ones or a favourite charity. It would allow you to construction your funds in such a approach that it is possible for you to to offer for the individuals or organizations you take care of most.

Retirement earnings: Aside from retirement planning, it’s additionally necessary to efficiently handle earnings in retirement. Your monetary advisor will take into accounts your earnings from Social Safety and pensions, in making a distribution plan out of your retirement financial savings.

How a lot does Side Wealth price?

The price of Side Wealth’s providers depends upon the providers you wish to pay for.

Side Wealth charges vary from $1,800/12 months (which is $150/month) to $6,000/12 months (which is $500/month) – and most shoppers fall in the midst of that vary relying on the complexity of your monetary panorama. They provide seven ranges of providers with costs that improve with the extent of providers rendered.

Whenever you break it down month-by-month, you may pay as little as $150 per 30 days to as a lot as $500 per 30 days for his or her providers. It simply depends upon your wants. And right here, a Side Wealth CFP® may even aid you select your worker advantages and supply help in making the proper choices together with your firm’s inventory choice plan.

Side Wealth options

Here’s what you may count on when you change into a Side Wealth consumer.

Dashboard

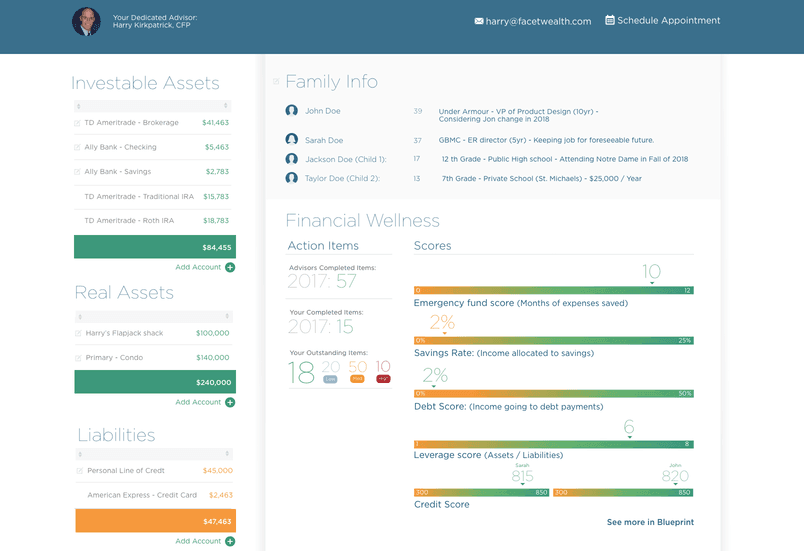

Along with providers and with the ability to contact your CFP® everytime you want, Side Wealth additionally gives a dashboard that will help you maintain monitor of your funds.

The dashboard permits you to hyperlink your monetary accounts so that you get a real-time view of your funds with out logging into a number of accounts.

The dashboard additionally highlights your targets and targets, in addition to key metrics like emergency fund standing, financial savings charge, debt rating, credit score rating, and extra making it straightforward to see a snapshot of your general monetary image.

Complete planning

One of many huge advantages of utilizing Side Wealth over a robo-advisor is Side Wealth’s complete planning choices. They’ll check out your total funding portfolio, together with your retirement investments, to ensure your funding technique is aligned together with your long-term targets.

And slightly than focusing solely on managing and rising your belongings, Side Wealth may help you with different necessary components of your monetary plan as effectively. For instance, Side Wealth takes a goals-focused method to your funding administration, utilizing the issues which are necessary to you to tell your funding recommendation.

For instance, when you inform them you’re hoping to purchase a home within the close to future, they could recommend methods to maneuver your cash that will help you save for the down cost in much less time.

Flat-fee

Lastly, one of many largest promoting factors is Side Wealth costs a flat price for his or her providers. This implies you obtain worth equal to what you pay, not based mostly on how giant your asset stability is or how huge of a fee your advisor is incomes from the providers they suggest.

Who’s Side Wealth greatest for?

Side Wealth is right for the next kinds of individuals.

Those that need recommendation, however no excessive charges

Side Wealth is greatest for these on the lookout for skilled monetary recommendation with out having to pay giant belongings beneath administration charges.

As an example, these with a $1,000,000 portfolio would pay $10,000 per 12 months beneath a standard monetary advisor with a 1% belongings beneath administration price. Nonetheless, even with Side Wealth’s most costly price, the fee could be just a bit greater than half the worth.

Those that desire a no-commission system

It’s additionally an awesome choice for those who don’t wish to marvel if the recommendation their advisor is giving them conflicts with the commissions the advisor could earn for suggesting a sure product.

Take into account, you must be comfy speaking via e-mail or on the telephone when you’ve questions. The excellent news is there isn’t any cancellation price when you discover out Side Wealth doesn’t find yourself being an excellent match for you.

Who isn’t Side Wealth for?

Some individuals could also be upset by what Side Wealth has to supply. Right here a few teams which may not be an excellent match for this service.

Newbie traders

Side Wealth received’t work for everybody. Particularly, these simply getting began won’t have to pay a whole bunch or hundreds of {dollars} every year for recommendation.

As a substitute, studying an excellent e-book on the fundamentals of index investing might present sufficient information to get began. When you construct sufficient belongings to want extra steering, Side Wealth could also be an excellent choice at that time.

Self-starters

As soon as your preliminary monetary plan is constructed, self-starters could not have to proceed paying for Side Wealth yearly. That stated, you’ll miss out on the advantages of continued recommendation that will help you handle life’s modifications when you don’t keep subscribed.

Those that need an in-person advisor

Lastly, those who like assembly with an advisor nose to nose will seemingly be higher off with an area monetary advisor.

My expertise utilizing Side Wealth

The Side Wealth expertise is targeted on offering complete monetary life administration at an inexpensive value.

Slightly than specializing in its automated choices and know-how, Side Wealth focuses on the connection you’ll construct together with your devoted Licensed Monetary Planner™.

As a substitute of counting on the fundamentals of asset administration, Side Wealth as a substitute gives goal recommendation on complete monetary planning based mostly on the extent of service you want.

You’ll obtain a welcome packet upon signing up

When you join their service, you’ll obtain a welcome packet that describes Side Wealth’s function as a fiduciary. It additionally shares the rules they comply with to supply its monetary planning providers.

You’ll fill out a questionnaire

You’ll should fill out an introductory questionnaire that features primary details about your self, your loved ones, and your funds, together with any monetary targets you might have.

Primarily based on the outcomes, your targets and monetary info will likely be displayed on a dashboard. The dashboard’s aim is to offer all your monetary info and targets in a single place in an easy-to-understand format.

You’ll then be assigned a CFP®

Subsequent, your CFP® will assist tailor the monetary planning expertise at Side Wealth based mostly on the providers you want. This consists of selecting the extent of service you want.

When you’re a consumer, you’ll have a collection of planning conferences to assist develop your private monetary plan which is able to in the end end in a doc referred to as your monetary blueprint. They will additionally break down particular person targets into one-page plans similar to making ready for faculty bills.

In fact, you may name any time to talk together with your skilled every time you’ve monetary questions.

Side Wealth vs. opponents

Side Wealth has many opponents, however all of them barely differ in how they work and cost for his or her providers.

Robo-advisors

In a approach, Side Wealth competes with robo- advisors. Robo-advisors usually cost a comparatively small share of the belongings they handle and supply primary monetary administration utilizing software program as a substitute of people.

Robo-advisors will usually aid you arrange your preliminary asset allocation and rebalance your portfolio when obligatory. They could additionally aid you construct a monetary plan.

As a result of decrease price of a robo-advisor’s providers, there’ll usually be little or no, if any, interplay with a human skilled.

Learn extra: Robo-advisors vs. monetary advisors: Which choice is greatest for you?

Wealthfront

Wealthfront is a real robo-advisor with free monetary planning options. This can be a stable choice if cheap monetary planning drew you to Side Wealth however you’ve much less capital and also you’re new to investing.

The Wealthfront algorithm will create and handle a portfolio for you with a mixture of exchange-traded funds that is sensible in your threat tolerance and targets, then rebalance it and prevent cash on taxes – all for a flat charge of 0.25% per 12 months. Wealthfront’s low charges and funding minimal of $500 make it an excellent choice for brand spanking new and intermediate traders alike.

You received’t get an funding advisor of your individual or the identical degree of customized planning providers from Wealthfront, however you’ll have free entry to an automatic platform that may assist you determine for your self what you must do to achieve your saving, investing, and web price targets.

Learn our full evaluation.

M1

One other competitor, M1 Finance, is a combination between robo-advisors and brokerage accounts. M1 Finance permits you to choose an funding combine, which they name pies. Should you’d like, you may create your individual customized funding combine as effectively.

When you choose an funding combine, M1 Finance will ensure you buy the right amount of every funding everytime you deposit cash to maintain your portfolio balanced.

M1 Finance stands out from different opponents as a result of their service is presently free. There aren’t any belongings beneath administration charges or different charges to make use of them, however they don’t present monetary planning.

Learn our full evaluation.

This text isn’t monetary recommendation. All investing entails threat, together with the danger of dropping the cash you make investments. Previous efficiency doesn’t assure future outcomes.

Private Capital

Companies like Private Capital mix the robo-advisor mannequin with a devoted skilled. They supply a web based dashboard that will help you monitor your funds and web price free of charge.

Companies like Private Capital mix the robo-advisor mannequin with a devoted skilled. They supply a web based dashboard that will help you monitor your funds and web price free of charge.

Should you’d like to make use of their monetary advisory providers, they cost a 0.89% belongings beneath administration price for the primary $1,000,000 in belongings. The price decreases on quantities above $1,000,000.

Relying in your stability, this price will be larger than utilizing a service like Side Wealth. In actual fact, the price might be fairly giant you probably have a variety of belongings.

Learn our full evaluation.

Private Capital Advisors Company (“PCAC”) compensates Webpals Methods S. C LTD for brand spanking new leads. Webpals Methods S. C LTD isn’t an funding consumer of PCAC.

Monetary advisors

Side Wealth additionally competes with conventional monetary advisors you will discover in your space or on-line. Conventional monetary advisors could earn their compensation via commissions on trades, charging belongings beneath administration charges, or charging hourly session charges.

Abstract

Should you don’t have knowledgeable that may aid you handle your monetary life and targets, take into account establishing an introductory name with Side Wealth to see in the event that they’re an excellent match in your wants.

There’s no threat upfront and Side Wealth’s aim is to make on-line monetary planning private and inexpensive for you.