How’s your funds trying? Are your investments rising towards your targets? How about that debt payoff plan?

In case your first response to those questions is “I don’t know…” don’t fear, there’s an app for that. A number of, really.

Getting a transparent image of your funds doesn’t should be arduous, and Private Capital and Quicken are two of the most effective apps that may enable you to keep organized (and sane) whereas placing collectively a monetary plan. However the two apps are designed for very totally different customers.

Private Capital vs. Quicken Abstract

| Private Capital | Quicken | |

|---|---|---|

| Value | Free for app customers; paid accounts obtainable for advisory providers | $41.88-$119.88 relying on the model |

| Budgeting Options | Fundamental budgeting with bills damaged down by class | Create a number of budgets with limitless expense classes

Set financial savings targets Calendar/fiscal yr budgeting |

| Funding Options | Retirement Planner and Price Analyzer

Entry to licensed monetary advisors (paid service) |

Monitor portfolio values over time (Deluxe)

Tax planning (Premier) Entry to Morningstar’s® Portfolio X-ray® device (Premier) |

| Accessible By way of | Internet app + iOS and Android | Desktop app + iOS and Android |

| Buyer Service | Telephone + in-person help at native workplaces | Telephone help, dwell chat, and group boards |

About Private Capital

Private Capital is a free app that was launched in 2011, and was not too long ago acquired by monetary providers supplier Empower.

Some options of the app embrace:

- Easy budgeting and spending overview

- Automated monitoring of monetary accounts

- Retirement planning

- Funding evaluation

- Financial savings targets

- Internet price tracker

- Money administration account with as much as $1.25M FDIC insurance coverage

Private Capital customers with a $100,000 internet price (or larger) additionally obtain personalised portfolio administration providers, together with entry to a devoted, licensed monetary advisor.

Private capital is on the market on-line and as a cell app for each Android and iOS telephones.

Learn extra: Do You Want a Monetary Advisor?

About Quicken

Quicken is likely one of the oldest budgeting and expense monitoring platforms round, providing a downloadable desktop software since 1983. Quicken remains to be obtainable as a desktop software for each Mac and Home windows, in addition to a companion app for iOS and Android units.

Quicken provides a complete suite of cash administration instruments, together with:

- Superior budgeting instruments with detailed reviews

- Full-service invoice pay

- Debt monitoring, administration, and planning

- Automated monitoring of monetary accounts

- Tax planning

- Dwelling & property administration

There are a number of variations of Quicken obtainable as a subscription, with totally different options for every model. Subscriptions are billed yearly.

Charges

Private Capital is a free app that doesn’t cost any charges. Private Capital does, nevertheless, supply a premium funding administration service by Private Capital Advisors, which prices an property underneath administration (AUM) charge for portfolio administration, beginning at 0.89%. Private Capital advisor providers are solely obtainable to shoppers with $100,000 of investable property (or extra), with charge reductions obtainable to shoppers with extra funds to speculate. Right here’s the charge breakdown:

| Property Beneath Administration | Annual Price |

|---|---|

| $100K-$1M | 0.89% |

| $1M-$3M | 0.79% |

| $3M-$5M | 0.69% |

| $5M-$10M | 0.59% |

| Over $10M | 0.49% |

Quicken provides a subscription service, billed yearly, with a number of variations of its software program obtainable. Every model provides entry to totally different options, with a deal with totally different buyer wants. Right here’s the pricing/characteristic breakdown of the totally different variations of Quicken software program:

| Quicken Plan | Annual Value | Options |

|---|---|---|

| Starter | $41.88 | Month-to-month budgeting, automated expense monitoring, invoice administration, export to Excel |

| Deluxe | $59.88 | Extra options: Debt Discount Planner, set financial savings targets, annual/fiscal yr budgets, internet price tracker |

| Premier | $83.88 | Extra options: Funding tax planning, Morningstar’s® Portfolio X-ray® device, property values from Zillow, Precedence help entry |

| Dwelling & Enterprise | $119.88 | Extra options: Schedule C & D tax planning, enterprise and rental property administration instruments |

Private Capital vs Quicken: Options

Budgeting

Private Capital has fundamental budgeting performance, and is designed extra for monitoring and analyzing your spending relatively than full-control budgeting. You’ll be able to join your monetary accounts and Private Capital will mechanically kind your transactions into spending classes, and present you a easy pie graph that particulars the place your cash is being spent.

You’ll be able to edit these class names, and edit particular person transactions as nicely, however you can not set a funds for every class. As a substitute, you possibly can set a month-to-month spending purpose, and Private Capital will enable you to monitor your progress all through the month. Once more, the budgeting instruments are fundamental, however when you merely desire a spending tracker that reveals the place your cash goes, it will get the job executed.

Quicken, alternatively, is an in depth and complete budgeting software program with a variety of options together with:

- Automated categorization

- Customized financial savings targets

- Capability to create a number of budgets

- Fiscal yr budgeting

- Finances recommendations primarily based on spending historical past

- Limitless spending classes

- Monitor recurring bills

- “What if” evaluation

Quicken’s month-to-month monetary overview

Quicken is a extra “hands-on” budgeting expertise with highly effective customization options that provide you with extra management over your month-to-month monetary planning.

Winner: Quicken, by a mile. Whereas Private Capital provides the fundamentals, Quicken is a full-fledged budgeting device that may be personalized to suit your way of life and spending wants.

Debt Administration

Whereas Private Capital doesn’t supply any debt administration instruments, you possibly can monitor your loans and bank cards by connecting them on the platform. This lets you see the stability of every debt account over time, however that’s it.

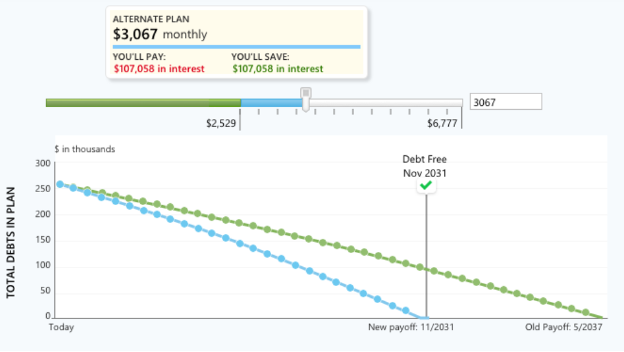

Quicken has a complete debt planning device referred to as the “Debt Discount Planner,” obtainable on the Deluxe plan or larger. The device mechanically finds your debt balances, debt rates of interest, and minimal funds, and places collectively actionable payoff plan situations primarily based on the overall quantity you wish to pay towards your money owed every month.

Quicken’s Debt Discount Planner

A “debt-free date” is projected primarily based on the assorted debt particulars and the way a lot you possibly can put towards the plan on a month-to-month foundation, and the device will show your projected curiosity financial savings as nicely.

Winner: Quicken, as its Debt Discount Planner provides an in depth plan for debt payoff.

Invoice Pay

Private Capital doesn’t supply direct invoice pay providers, however does embrace reminders that warn you of upcoming payments. These reminders are mechanically set primarily based in your recurring bills out of your linked accounts, they usually can’t be adjusted. This characteristic is a bit clunky, and the shortcoming to take away payments that don’t exist any longer is a bit cumbersome.

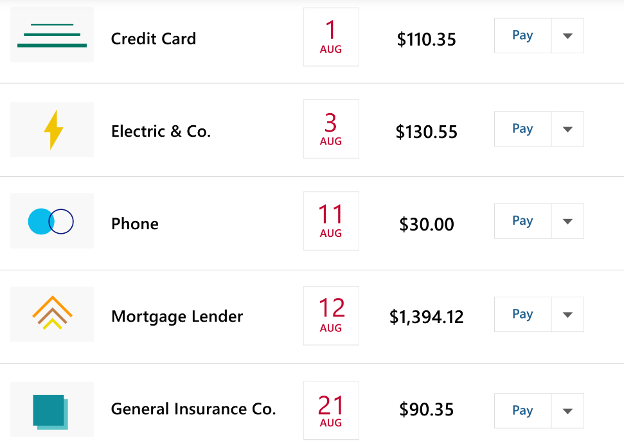

Quicken permits you to add and monitor payments inside its software program, set alerts for fee dates, and get notifications for when a invoice has been paid. It additionally permits you to instantly make invoice funds by your linked checking account, and may submit “examine pay” requests that immediate your financial institution to mail out a examine in your behalf (obtainable in Premier plans or larger).

Quicken’s invoice pay characteristic

Winner: Quicken provides much more complete invoice pay providers and planning than Private Capital.

Funding Monitoring

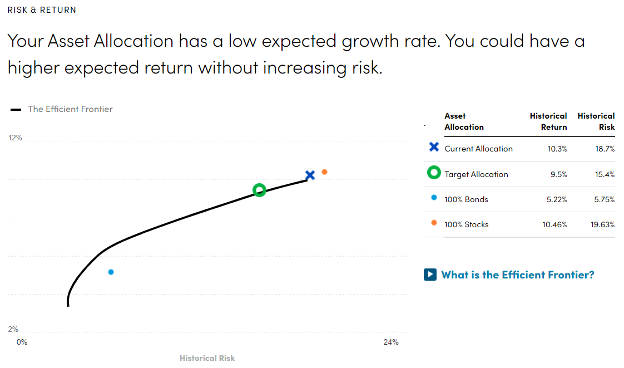

There are a variety of funding monitoring & evaluation instruments obtainable on Private Capital’s free platform, together with:

- Breakdowns of your complete funding holdings throughout all linked accounts.

- Historic views of your funding balances over time, by account.

- Overviews of every funding’s efficiency, with the flexibility to check to different asset courses.

- A full breakdown of your funding asset allocation by asset class.

- A breakdown of the U.S. funding sectors inside your portfolio.

Private Capital’s Funding Checkup device

Quicken provides some funding monitoring options for Premier and Dwelling & Enterprise plans solely, together with:

- Automated funding monitoring, together with charges and returns

- Asset allocation (Home windows solely)

- Inventory watch lists

- Entry to funding evaluation instruments from Morningstar

- Funding tax planning

- “Lifetime Planner” device for retirement planning

Winner: Private Capital provides very detailed funding monitoring and evaluation instruments without cost, whereas Quicken provides much less instruments with a excessive value.

Retirement Planning

Each Private Capital and Quicken have retirement planning options, permitting you to judge your general monetary plan and create “what if” situations to see how financial savings charges and main purchases can impression your plan.

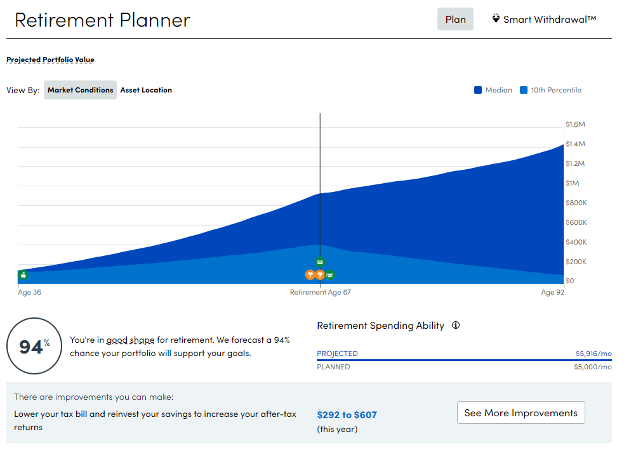

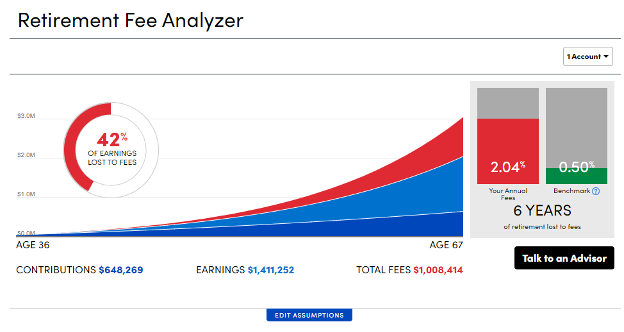

Two of Private Capital’s standout options are the Retirement Planner and the Retirement Price Analyzer. The Retirement Planner provides an evaluation of your present funding holdings and pairs it along with your financial savings plan and (projected) social safety earnings to let you already know when you’re on monitor for retirement.

The Retirement Price Analyzer mechanically detects the annual charges paid for all linked funding accounts, displaying the impact of these charges over your lifetime, and evaluating with nationwide averages that can assist you see when you’re overpaying.

Along with the various funding evaluation and planning instruments obtainable with its free model, Private Capital additionally provides paid wealth administration providers for accounts with over $100,000 obtainable to speculate. This full-service monetary planning agency provides customers 1-on-1 entry to a licensed monetary advisor, with the flexibility to create a customized monetary plan, and hands-off portfolio administration.

You’ll be able to be taught extra about Private Capital’s funding monitoring and retirement planning options by studying our full Private Capital overview.

Quicken provides a “Lifetime Planner” device that permits you to enter your monetary particulars and mannequin totally different future situations, displaying projected monetary outcomes. You’ll be able to set targets for retirement, shopping for a home, or school financial savings, and the planner will assist present how your saving and spending habits will impression these plans. The device isn’t absolutely automated, and does require a little bit of enter from customers, however will help you set collectively a plan in your cash.

Winner: Private Capital provides much more capabilities for retirement planning (without cost), in addition to a paid full-service monetary planning agency obtainable to shoppers with over $100K to speculate.

Consumer Interface

Private Capital is a completely on-line platform with a feature-rich cell app, providing you with an intuitive overview of your funds and investments. The cell app provides notably easy views and could be very simple to navigate.

Quicken, alternatively, is a desktop software (no net app obtainable), requiring downloading and putting in the software program in your PC or Mac. Its consumer interface offers a easy image of your spending habits and classes. The cell companion app is, sadly, very restricted, and doesn’t supply the identical options obtainable on the desktop model.

Winner: Private Capital is the higher of the 2 consumer interfaces, providing a extra seamless expertise, with an intuitive cell app that offers you all of the options obtainable on the net model.

Help

Each Private Capital and Quicken supply help over the telephone throughout enterprise hours, in addition to a complete help heart with detailed “how you can” articles and entry to e-mail help.

Private Capital provides telephone help Monday – Friday, 8 a.m. to six p.m. PT, and in-person help at one among eight native workplaces situated in California, Texas, Colorado, Georgia, Illinois, and New York.

Quicken provides telephone help Monday – Friday, 5 a.m. to five p.m. PT, in addition to dwell chat help seven days every week, from 5 a.m. – 5 p.m. PT. There may be additionally a group discussion board obtainable 24/7 for help from different Quicken customers.

Winner: Tie. Each Quicken and Private Capital supply complete help programs and telephone help to speak to a dwell human.

Private Capital vs. Quicken Execs and Cons

Private Capital Execs

- Free for fundamental stage

- Big selection of funding and retirement planning instruments

- Price analyzer helps spotlight hidden investing charges

- Constructed-in money administration account

Private Capital Cons

- Restricted budgeting and debt administration options

- No invoice pay obtainable, and alerts are a bit clunky

- Monetary advisors solely accessible to customers with $100K+ internet price

Quicken Execs

- Tried-and-true budgeting software program

- Actionable debt payoff plans

- Complete invoice pay options

- Extremely customizable

Quicken Cons

- Comparatively restricted funding and retirement planning options

- Cell app very restricted

- Desktop model have to be downloaded (no net app)

- Prices as much as $119.88 per yr, with no free model obtainable

Who Ought to Select Private Capital?

Private Capital is right for customers who need entry to free funding evaluation and planning instruments. With a built-in charge analyzer and retirement planner, you possibly can shortly stand up to hurry in your progress towards retirement, and reduce out pointless charges out of your portfolio. The budgeting instruments aren’t nice, however when you merely wish to monitor your spending in varied classes, Private Capital will try this mechanically.

Get began with Private Capital right here.

Who Ought to Select Quicken?

Quicken is a strong cash administration app that may very well be notably helpful for these trying to change their monetary habits or repay long-term debt. With the flexibility to fine-tune your funds down the penny, create a number of energetic budgets, and examine exhaustive spending reviews, it’s very best for detail-oriented customers who desire a fully-customizable suite of budgeting instruments and options.

As a downloadable desktop software program product, Quicken is greatest for customers that love to do their monetary planning on their laptop, with the cell apps being extra of an adjunct than a most important characteristic. Mac software program limitations make Quicken a greater match for Home windows customers.

Get began with Quicken right here.

Abstract

Private Capital might be higher for a majority of customers who desire a easy, free device to judge their investments, with non-obligatory entry to paid portfolio administration. It’s most likely the most effective free investing app obtainable right now.

Quicken is extra suited to budget-conscious customers who need full management of each greenback they’ve, and may benefit from the flexibility to handle their enterprise and private funds multi function software program bundle. The month-to-month value doesn’t appear price it except you’re a small enterprise proprietor or actual property investor who wants extra complete monetary instruments.