Quicken has been one in every of my private favourite instruments to trace my funds since I graduated from faculty in 2009. They launched new software program every year, however you might proceed utilizing the older variations for those who didn’t need to improve.

You possibly can nonetheless use a number of the older variations of Quicken in your laptop at the moment. You simply can’t routinely obtain transactions with out an annual subscription. As a substitute, it’s a must to manually enter transactions.

This is usually a painstaking course of. Since it’s a must to pay an annual subscription to proceed utilizing all of Quicken’s options, you might need to think about your different choices.

Listed here are the professionals and cons of a number of different of my favourite cash administration options.

Empower

Empower is an organization that makes cash by managing folks’s investments. That mentioned, Empower additionally presents cash administration software program as a method to expose folks to their model and purchase new clients over the long term. They provide a web-based resolution, an iOS app, and an Android app.

Empower means that you can hyperlink your monetary accounts to their software program. As soon as linked, transactions imported routinely. Then, Empower supplies loads of detailed reviews that can assist you handle your funds primarily based on that info.

I exploit Empower to trace my web value as a result of it consolidates all of my accounts in a single place. I sometimes use a few of their different options, however I don’t use it to trace my earnings or bills.

Options

Present private finance instruments Empower presents free of charge embody:

- Internet value monitoring.

- Budgeting.

- Invoice-tracking.

- Money circulation.

- Funding evaluation.

- Retirement planner.

- Financial savings planner.

- Payment analyzer.

As soon as your web value reaches a sure stage, Empower monetary advisors will attain out to you to supply their fee-based companies.

I personally don’t use their fee-based funding administration, however you’ll have to resolve whether it is value it for your self. You possibly can nonetheless use the free software program no matter whether or not you utilize their fee-based funding administration companies.

Empower professionals

- Free to make use of.

- Tracks greater than solely web value.

- Automated syncs with many accounts.

Empower cons

- After you attain a specific amount of belongings, count on calls attempting to promote their funding companies.

- Accounts can have hassle syncing.

- Free instruments are an addition to the principle Empower providing so will not be as in-depth as budgeting targeted options.

(Private Capital is now Empower)

Be taught extra about Empower or learn MU30’s full assessment.

You Want a Funds (YNAB)

You Want a Funds, generally referred to as YNAB for brief, is a budgeting software constructed from a person’s home made budgeting instruments. The software program has grown by leaps and bounds since then and now focuses on giving budgeters the instruments they should funds and succeed.

The software program is predicated round a 4 rule budgeting system. When you perceive the principles, the software program helps you comply with them to funds whereas attempting to keep away from frequent failures. The foundations are:

- Give each greenback a job.

- Embrace your true bills.

- Roll with the punches.

- Age your cash.

Options

The software program comes with loads of options, too. They embody:

- Entry to your information from any system.

- Budgeting instruments.

- Purpose monitoring.

- Spending, web value in addition to earnings and expense reviews.

You possibly can subscribe to YNAB for $11.99 per 30 days or lower your expenses by paying $84 yearly. You should utilize YNAB virtually wherever you’re. They’ve a web-based possibility, iOS app, Android app and even apps for iPad, Apple Watch and Alexa.

I just like the idea of YNAB and consider this software program can be tremendous helpful in serving to somebody funds efficiently in the event that they have been simply getting began budgeting. Nonetheless, I’m at a distinct stage in my monetary life and like to stay with what I’ve used up till this level.

YNAB professionals

- 34-day free trial.

- Budgeting primarily based on a philosophy that can assist you achieve success.

- Free programs and video workshops.

- Hyperlink accounts to the YNAB app.

- Many apps to trace your cash wherever, together with Alexa.

YNAB cons

- Month-to-month or annual subscription cost required after free trial.

- Budgeting targeted on YNAB’s methodology which can not work for everybody.

Be taught extra about YNAB.

Unifimoney

*Editorial Notice: This provide is not out there. Please go to the Unifimoney web site for present phrases.

Primarily based in San Francisco, Unifimoney focuses on automating the various time-consuming duties related to cash administration.

Unifimoney is ideal for many who need to get began with investing however don’t actually have the additional bandwidth to study a brand new platform. With Unifimoney, you get a high-yield checking account, in addition to a financial savings account and a bank card that grow to be your all-in-one digital cash administration app. The app is at present solely out there to iOS customers, however Unifimoney hopes so as to add Android and Desktop entry sooner or later.

Options

When you’ve made your $100 minimal deposit and arrange your account, you’ll get entry to the next options:

- Checking stability earns 0.20% APY.

- Invoice pay, direct deposit, distant verify deposit, and a debit card.

- Payment-free ATM entry.

- Curiosity might be directed to your portfolio.

- Fee-free investing.

- Cryptocurrency and valuable metallic investing.

If, like me, you’ve been enthusiastic about investing in cryptocurrencies, Unifimoney can actually turn out to be useful. With greater than 30 totally different cryptocurrencies supported, you may construct a portfolio that features cryptocurrencies and valuable metals alongside shares and ETFs. You possibly can have your curiosity routinely moved to your portfolio, in addition to a minimal month-to-month quantity beginning at $25.

The Unifimoney checking account packs loads of options, together with invoice pay, distant verify deposit, and even a checkbook in case you ever want it. It’s also possible to join a bank card (Unifi Premier) that may roll out in Q3 incomes 2% money again, with the choice of placing that money into your investments.

Unifimoney professionals

- Excessive-yield checking with 0.2% APY.

- Full-featured checking, together with invoice pay and direct deposit.

- Automated investing in cryptocurrencies and different belongings.

- Self-guided, commission-free investing.

- Unifi Premier bank card earns you money again of two%.

Unifimoney cons

- Minimal stability or month-to-month deposits required for fee-free checking.

- No money advance characteristic.

- $100 minimal opening stability.

Be taught extra about Unifimoney.

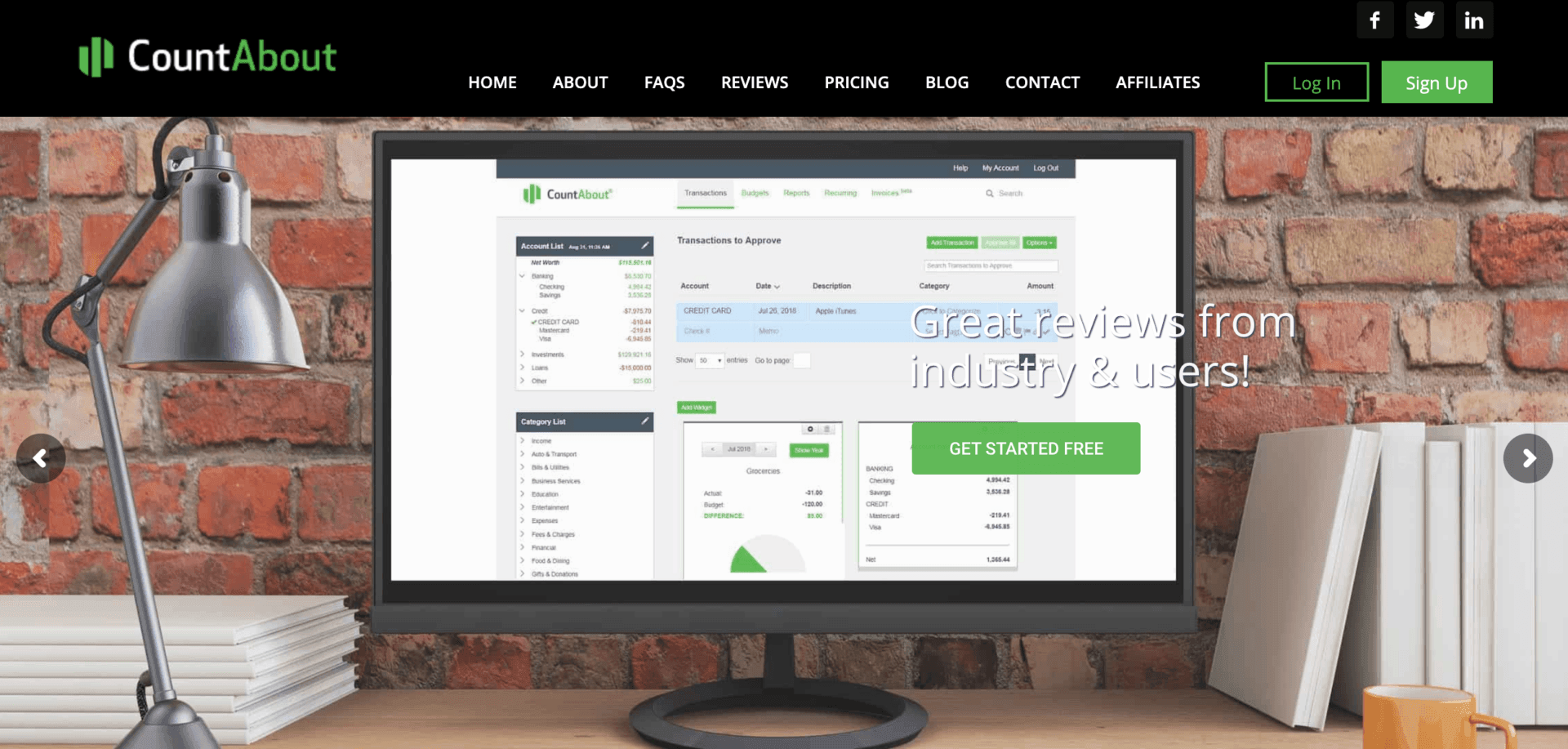

CountAbout

CountAbout is a web-based private finance app that means that you can import your historic knowledge from Quicken or Mint. If you happen to’re switching software program, it’s at all times good to deliver your historical past with you. You possibly can both use their web-based app, iOS, or Android apps. It additionally presents a free 15-day trial.

Options

CountAbout presents many options that may aid you handle your funds. Specifically, they provide the next options:

- Budgeting.

- Customizable classes and tags.

- Recurring transactions.

- Automated transaction downloads (with a Premium subscription).

- Attaching receipts to transactions ($10/yr further price).

- Monetary reviews.

- Invoicing capabilities ($60/yr further price).

- FIRE widget.

- No ads.

Pricing begins at $9.99 per yr for a Primary subscription. This enables handbook enter of transactions or file imports from QIF information. If you happen to’d slightly have your transactions routinely downloaded, it’s included within the Premium subscription which prices $39.99 per yr.

CountAbout additionally presents add-ons. If it is advisable connect pictures, that will increase the value by $10 per yr. Including invoicing capabilities will increase the value by $60 per yr. I like the truth that I might import my Quicken knowledge if I made a decision to modify, however the annual price and the barrier of studying new software program have saved me from switching to CountAbout.

CountAbout professionals

- Free 15-day trial.

- Can import historical past from Quicken.

- Can routinely obtain transactions with a Premium subscription.

- Invoicing capabilities for small companies with a price.

- Means to trace your FIRE timeline.

- Net-based or telephone apps out there.

CountAbout cons

- Requires an annual subscription for even essentially the most fundamental possibility.

- Add-on charges can add up for those who want invoicing or picture attachment choices.

Be taught extra about CountAbout or learn MU30’s full assessment.

Pocketsmith

Pocketsmith is a sturdy monetary administration software you need to use to get an summary of your funds. It has a web-based resolution in addition to an iOS and Android app you need to use.

Options

PocketSmith presents a number of options together with:

- Dashboard overview.

- Internet value statements.

- Revenue and expense reviews.

- Money circulation reviews.

- Automated financial institution feed importing.

- Categorization and labeling primarily based by yourself classes.

- Budgeting with the pliability to satisfy your wants together with every day, weekly, month-to-month and extra choices.

- Helps a number of currencies in spending accounts, belongings and liabilities.

- Forecasting instruments.

- A funds calendar that can assist you visualize your payments and their due dates.

- What-if situations to check your forecasting towards a number of choices.

Whereas most apps give attention to U.S.-based shoppers, this app means that you can mix accounts throughout many nations and currencies. This may also help international residents get a single view of their international funds.

This isn’t an enormous deal for me as all of my funds are primarily based in U.S. {Dollars}, however I might see it serving to others with extra sophisticated funds handle their cash simpler.

Pocketsmith professionals

- Automated financial institution feeds from over 12,000 establishments.

- Many reviews and forecasting instruments.

- Handle currencies, belongings, and liabilities from a number of nations in a single place.

- Affords a reduction for an annual subscription.

- Safe two-factor authentication.

Pocketsmith cons

- Month-to-month subscription price or annual price with a reduction.

- Premium and Tremendous subscriptions are comparatively costly in comparison with different choices.

Be taught extra about Pocketsmith or learn MU30’s Pocketsmith assessment.

Evaluating all of the options

| Empower | CountAbout | Pocketsmith | YNAB | Unifimoney | |

|---|---|---|---|---|---|

| Value | Free fundamental service, with an additional value for monetary administration | Begins at $9.99/yr | Free-$19.95/month | $11.99/month or $84/yr | Free so long as you meet minimal stability necessities, that are $20,000 in your account or $2,000 in direct deposits every month |

| Primary options | • Internet value monitoring • Budgeting • Invoice-tracking • Funding evaluation • Payment analyzer |

• Budgeting • Automated transaction downloads • Monetary reviews • Attaching receipts to transactions • FIRE widget |

• Internet value overview • Revenue and expense reviews • Budgeting • Forecasting instruments |

• Budgeting • Purpose monitoring • Internet value, spending, earnings reviews |

• Excessive-yield checking • Automated investing • Cryptocurrency investing • Free ATM withdrawals |

What’s Quicken?

Quicken is a cash administration software program that may aid you handle your private funds, investments, rental properties, and enterprise.

You possibly can full the next duties with Quicken relying on the extent of software program you buy:

- Handle spending.

- Budgeting.

- View and pay payments.

- Monitor investments.

- Plan to your retirement.

- Handle a enterprise.

- Handle rental properties.

The software program is out there for Home windows or Mac computer systems however the residence and enterprise model isn’t out there on Macs. Quicken additionally has a cell companion app that’s out there for iOS and Android units.

You should buy a subscription primarily based in your wants beginning at $34.99 and going as much as $89.99 for one yr. A two-year subscription possibility runs from $69.98 to $159.98 relying on the software program you want.

Monitoring your funds is best than avoiding a call

It’s extra necessary to trace your funds than choosing the proper software program to take action. Monitoring your funds provides you a transparent image of the place your cash goes. It additionally provides you alternatives to search out areas the place you may enhance.

I do know after I began monitoring my funds, I turned way more acutely aware of each expenditure I made. Did I actually need it? Or was there a greater use for the cash?

Decide a monitoring software program from the above listing and begin monitoring your funds at the moment. If you happen to discover out it doesn’t work, you may at all times change later when you get an concept of the options you want or need.

Abstract

Choosing a substitute for Quicken will rely in your particular funds and your wants. Whereas all the above software program options can observe your funds, you’ll want to determine which one works greatest for you.

It could take some trial and error, however discovering the proper software program resolution to trace your funds could make the duty a lot simpler and can help you begin bettering your funds shortly.

Learn extra:

Empower Private Wealth, LLC (“EPW”) compensates Webpals Programs S. C LTD for brand spanking new leads. Webpals Programs S. C LTD shouldn’t be an funding consumer of Private Capital Advisors Company or Empower Advisory Group, LLC.