There comes a degree in each younger skilled’s life once you notice: Hey. I work onerous and earn good cash. I can afford a pleasant automobile, proper?

So that you crunch some numbers and notice: Holy moly! I can afford a pleasant automobile!

However then you definitely keep in mind that the month-to-month cost is only the start. There’s additionally insurance coverage, oil modifications, parking passes, tires, windshield wipers, and extra to contemplate when budgeting for a automobile buy.

That’s to not say you can’t afford a pleasant automobile — we simply wish to remove any surprises and make sure you keep on funds whereas driving your new whip into the sundown.

My response after I notice I can afford a pleasant automobile, neglect the true value of possession, then notice I can nonetheless afford it | Supply: gfycat.com

So what are the seven true whole prices of automobile possession? How a lot must you funds for every? And in the event that they push the automobile you need out of funds, what are my high ideas for saving as much as 40%?

Let’s dive into the seven true prices of automobile possession (and learn how to shrink them down).

TL;DR: Proudly owning a automobile prices round $940 a month

All issues thought-about, having a automobile in your life will value round $940 a month all-in.

AAA’s estimate was $894 for 2022, however my estimate is somewhat larger as a result of people beneath 30 have larger insurance coverage premiums. AAA additionally didn’t embrace parking of their estimate, which I focus on under.

In any case, earlier than breaking down the seven true prices of proudly owning a automobile, let’s discuss in regards to the very first one: the price of the automobile itself.

How a lot does the typical automobile value?

In 2022, the typical value of latest and used automobiles topped $47,000 and $33,000, respectively. Excessive demand, low stock, and inflation all performed a job in costs creeping up, particularly for brand spanking new automobiles.

To be taught exactly how a lot automobile you may safely afford, try our Automotive Affordability Calculator. You’ll be taught in regards to the 35% rule, when leasing is smart over shopping for used, and whether or not you must pay money or finance.

However in the long run, your month-to-month cost is only one small a part of the true value of possession.

The 7 true prices of automobile possession

1. Month-to-month financing or lease funds: ~$450/month

Naturally, your first massive expense shall be your month-to-month mortgage or lease cost.

Let’s say you buy a used 2019 Toyota Camry for $25,000 with 20% down. Your credit score rating is a stable 690, so that you rating 5% APR for 36 months.

Looking at our useful Auto Mortgage Calculator, your month-to-month cost will come out to $485.53. It’s roughly the identical cost in case you lease a brand new one, which is why I strongly advocate financing a used automobile over leasing a brand new one. Within the former case you’re constructing fairness till you personal the automobile outright, whereas with a lease it’s a must to restart each few years.

You possibly can at all times stretch your mortgage time period from 36 to 48 months to decrease your month-to-month cost to $373.07. However I don’t advocate going longer than 48 months because you’ll be paying far more in curiosity and danger going underwater (the place you owe greater than the automobile is price).

However the important thing takeaway is that this: your month-to-month cost sometimes represents ~50% of your true value of possession.

Let’s cowl the opposite half.

2. Gas/charging: ~$150/month

Your subsequent value of automobile possession shall be paying for gasoline (or electrical energy to your EV).

In keeping with AAA, in This fall 2022 the typical value of gasoline nationwide has plummeted from practically $5.00 to only $3.68. So in case you drive a 30 MPG automobile 15,000 miles a 12 months, you’ll wish to funds $1,840 per 12 months, or $153.33 monthly for gasoline.

The unstable value of gasoline is the primary cause why people contemplate getting an EV, however though recharging an EV is approach cheaper, there are different prices to contemplate.

Will proudly owning an EV just like the slick Ford Mach-E actually prevent cash?

As an example, charging an EV at a public station like Bluedot prices round $0.10/mile or $1,500 per 12 months to drive 15,000 miles. It’s solely $0.03/mile ($450/12 months) in case you cost at house, however if you wish to get greater than 15 miles of vary per night time, you’ll want to put in a Degree 2 charger for ~$2,000.

So until you will have entry to a free Degree 2 charger in your parking deck, the price of gasoline and charging come out to roughly the identical lately.

Learn extra: The true value of proudly owning an electrical automobile

3. Upkeep and repairs: ~$150/month to $600/month

Right here’s the place issues can range wildly relying on which make and mannequin automobile you go together with. As a result of whereas a 2019 Toyota Camry and a BMW 3 Sequence might each value round $28k to purchase used, one prices tens of hundreds extra to personal.

First, there’s the distinction between upkeep and repairs.

Upkeep is common, routine stuff that each automobile wants to remain on the highway. Issues like:

- Oil modifications

- Fluid top-offs

- Tire balancing and rotation

- Alignments

- Automotive washes (to protect your paint)

- Filter replacements

Repairs, alternatively, are unplanned fixes to elements that broke or went flawed. Issues like:

- Leaky transmissions

- Falling suspension parts

- Unhealthy wiring and electronics

- Failed motors (window, sunroof, and so on.)

- Brake failure

And extra.

Consequently, the price distinction between proudly owning a dependable versus unreliable automobile could be staggering. For example, my 2008 IS 350 has wanted simply $710 in repairs within the final 15 years. Against this, Doug DeMuro’s 2006 Vary Rover wanted $15,659.51 in repairs inside 4 years.

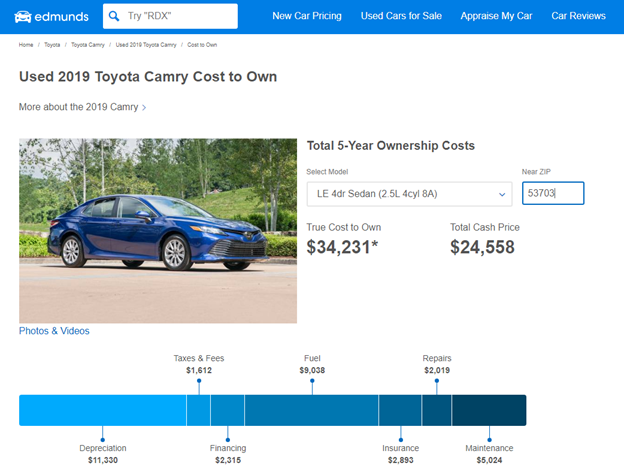

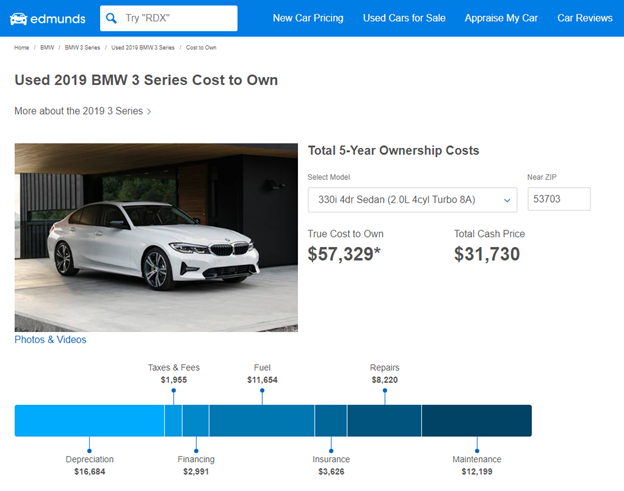

Leases naturally value much less in upkeep and repairs because the vendor will cowl most of them, however in case you purchase a used automobile, undoubtedly verify the Edmunds True Price to Personal before you purchase.

Utilizing that instrument, you may see how the price of sustaining and repairing a Toyota Camry for 5 years is $7,043, whereas the price to personal an equal Bimmer is $20,419.

Supply: Edmunds

Supply: Edmunds

4. Insurance coverage: ~$150/month

In keeping with PolicyGenius, the nationwide common for full protection auto insurance coverage is $1,662 yearly or $138.20 monthly. Since we’re younger and younger drivers pay extra, we’ll name it $150 to be secure.

However what in case you don’t need full protection (legal responsibility + collision + complete)?

Nicely, most lease/mortgage agreements require you to have full protection till you personal the automobile outright, because it’s technically another person’s property.

Fortunately, even on the full protection degree, there are tons of the way to avoid wasting as much as 40% in your auto insurance coverage.

5. Registration, taxes, and charges: ~$10/month (~$120/12 months)

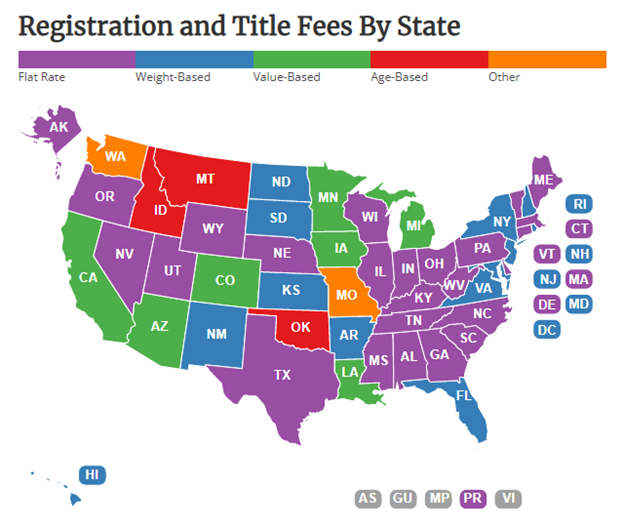

When you pay gross sales tax in your preliminary buy, your annual taxes and charges could be fairly low-cost relying in your state.

The Nationwide Convention of State Legislatures has a useful interactive map for rapidly discovering your state’s registration and title charges. In Georgia, for instance, they’re simply $20 and $18 respectively.

Supply: NCSL interactive map

North Dakota has the best annual registration charges at $274, however most states are beneath $100. So not a big value, however a value nonetheless!

6. Parking: ~$0 to $350/month

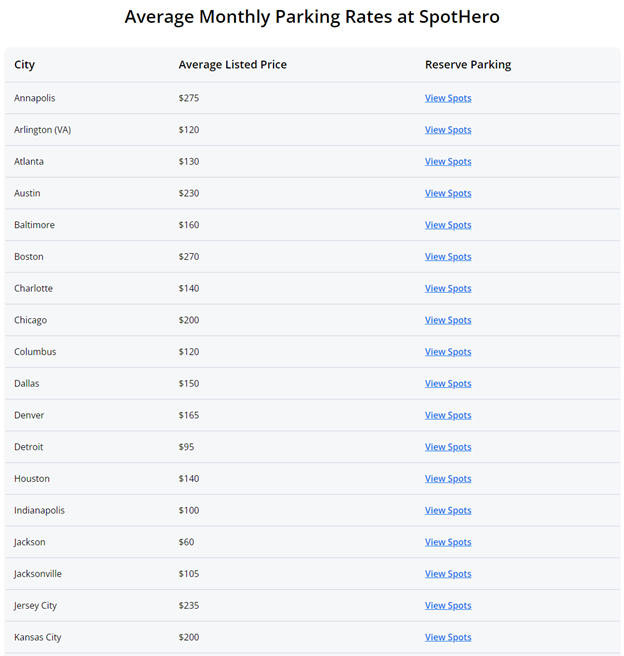

Most lists like this don’t embrace parking as an expense (not even AAA does). However contemplating parking can value greater than insurance coverage I believe it’s undoubtedly price a (dis)honorable point out!

In keeping with SpotHero, the month-to-month value to park in U.S. cities tends to vary from $50 in Cell to $340 in San Francisco, with the typical hovering round $150. You possibly can see the complete listing right here.

Supply: SpotHero month-to-month parking estimates

So along with checking the Edmunds True Price to Personal, you undoubtedly wish to estimate the “True Price to Park” your new automobile. Does your landlord provide free parking? How about work? And the way typically will you be going into the town for an occasion with dear parking ($30)?

7. Depreciation: ~$250/month

The ultimate “value” related to proudly owning a automobile is depreciation, aka your automobile’s sliding market worth over time.

I put “value” in quotes as a result of depreciation isn’t a month-to-month, out-of-pocket expense. It solely actually reveals up once you go to promote the automobile in 1, 3, or 10 years.

To make use of the Camry versus 3 Sequence instance from above, you’ll see how a Camry depreciates very slowly. In 5 years, it’ll solely lose $11,330 of its worth; meaning in case you promote it in 5 years, you’ll solely have paid $24,558 – $11,330 = $13,228 to personal it throughout that point.

That’s $220.47/month, minus the curiosity you pay your lender plus different bills.

BMWs, alternatively, depreciate sooner resulting from their blended fame for longevity. On the finish of 5 years your 3 Sequence will solely retain $15,046, or 47.4% of its worth. Which means when you promote it, you’ll have paid $251.27 monthly to personal it for 5 years (once more, minus curiosity and different bills).

Depreciation by no means applies to a lease because it’s by no means your automobile to promote, and EVs are likely to depreciate even sooner resulting from vary deterioration, expiring battery warranties, and the uncomfortable actuality that almost all EVs will want new batteries round 10 years in at a value of $8,000 to $20,000.

The overall prices of proudly owning a automobile

Alright, let’s tally it up!

- Month-to-month mortgage/lease cost: ~$450/month

- Gas/charging: ~$150/month

- Upkeep and repairs: ~$150/month

- Insurance coverage: ~$150/month

- Registration, taxes, and charges: ~$10/month

- Parking: ~$30/month

- Depreciation: ~$250/month

- Whole out-of-pocket prices (not together with depreciation): $940/month

If that quantity was somewhat larger than you have been hoping, how can we chisel it down?

How to save cash on proudly owning a automobile

As a automobile dealer with years of expertise, listed here are my high ideas for saving cash on all seven classes of automobile possession:

- Month-to-month cost: Finance a dependable, 3+-year-old automobile. Select a 36- or 48-month time period with a lender from our listing of the Greatest Auto Mortgage Charges, and make sure they cost no origination charges nor early compensation charges in order your earnings rises, can repay your auto mortgage sooner and save on curiosity.

- Gas/charging: Get a Costco/Sam’s Membership/BJ’s card and save ~$0.25/gallon. When you’re driving 25k+ miles/12 months, contemplate a gasoline rewards card. For EV charging, don’t count on to avoid wasting on “gasoline” until you will have entry to free charging.

- Upkeep and repairs: Purchase from a top-three dependable model (Toyota/Lexus/Mazda). Skip the prolonged guarantee and get pre-purchase inspection (PPI) inside the automobile’s return window as an alternative to make sure high quality. For upkeep, educate your self the straightforward stuff (wipers, filters, and so on.) and discover an skilled, reliable mechanic close by for the massive stuff. Skip the vendor and low high quality nationwide chains (Jiffy Lube, Firestone, and so on.).

- Insurance coverage: Learn our automobile insurance coverage information to itemize precisely how a lot of what sort of insurance coverage you want, then get quotes from at the least 5 of our picks for the Greatest Automotive Insurance coverage Corporations.

- Registration, taxes, and charges: Not a lot you are able to do on this entrance, in addition to shopping for your automobile in one other state with decrease gross sales tax and driving it house.

- Parking: At all times have a plan for parking. Know the place the free parking is, and verify SpotHero and related websites for nice month-to-month charges.

- Depreciation: Most automobiles lose 40% of their worth inside the first three years. So shopping for used can prevent $10,000+ in upfront prices and depreciation.

The underside line

At ~$940 a month, automobiles aren’t low-cost. But when they enhance your high quality of life by consolation, comfort, or the sheer pleasure of whipping round corners, they will completely be price it.