In response to a 2020 ballot printed by the Longevity Mission and Morning Seek the advice of, solely 13% of Millennials count on to depend upon Social Safety as a main supply of revenue throughout retirement.

The place did such a bleak outlook come from? Nicely, Millennials aren’t simply being cynical; the Social Safety Administration has been telling us for years that:

“the Previous-Age and Survivors Insurance coverage (OASI) Belief Fund, which pays retirement and survivors advantages, will be capable of pay scheduled advantages on a well timed foundation till 2034.”

There are essential caveats to that determine, nevertheless, and even some excellent news on the Social Safety entrance for Millennials.

What’s Social Safety?

Supply: zimmytws/Shutterstock.com

There’s a preferred false impression that Social Safety is sort of a large shared pool of cash that the working technology contributes to to allow them to all share it after they retire. In actuality, it’s even less complicated than that.

As an alternative, Social Safety is a direct switch of wealth from the working technology to present retirees and disabled of us. It’s not an funding account. The cash you pay into Social Safety with every paycheck doesn’t sit round incomes curiosity and are available again to you once you retire; the cash you pay in instantly flows out to pay advantages to your grandmother, your pal who’s on incapacity, and hundreds of thousands of others like them.

In response to the Social Safety Administration, 49 million folks obtained Social Safety advantages in June of 2020 whereas round 150 million employees had been paying into it.

The place did Social Safety come from?

The Social Safety Administration has a surprisingly cool web page devoted to the historical past of Social Safety. Principally, for millennia mankind has tinkered with the thought of an financial security internet for anybody who can’t work, and usually, it’s labored fairly effectively.

The earliest documented type of Social Safety was by the traditional Greeks, who stockpiled long-lasting olive oil to stop financial wreck or hunger. All through the Center Ages, you possibly can depend upon your guild or union to assist you thru “retirement,” and England formally codified the thought of Social Safety within the seventeenth century.

The American Social Safety system was a direct response to the destitution of the Nice Despair. FDR signed Social Safety into legislation in 1935, and after years of misguided lump sum funds (that didn’t go notably effectively), the federal government transitioned to a month-to-month fee system.

The primary-ever United States Social Safety examine was issued in 1940 to a secretary in Vermont named Ida Could Fuller. She obtained $22.54.

Who qualifies for Social Safety?

One other widespread false impression is that Social Safety is mainly only a authorities allowance for retirees. That’s true, however not the entire fact. A full 20% of Social Safety recipients aren’t retired.

Social Safety advantages all the following teams:

- Retirees.

- The disabled.

- A partner or little one of somebody getting advantages.

- A divorced partner of somebody getting or eligible for Social Safety.

- A partner or little one of a employee who died.

- A divorced partner of a employee who died.

- A dependent mum or dad of a employee who died.

And so forth.

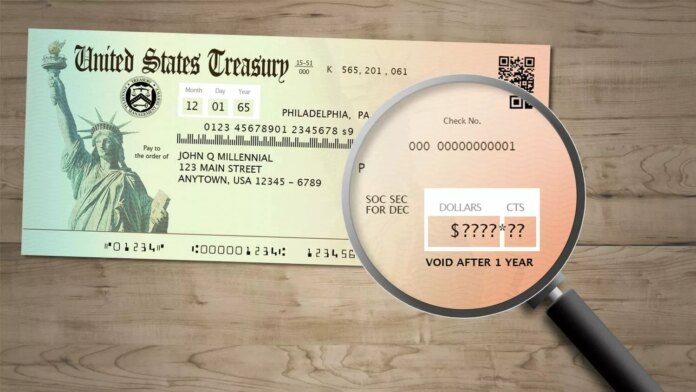

How a lot does Social Safety pay?

Everybody collects a distinct quantity of Social Safety. The amount of cash you obtain from Social Safety is dependent upon your common listed month-to-month earnings (AIME) throughout your 35 highest-earning revenue years. When you retire, Social Safety can pay you between 1 / 4 and a half of your AIME (accounting for inflation). Decrease earners will earn a higher proportion of their former month-to-month paycheck.

In 2021, the utmost month-to-month payout for somebody on Social Safety is $3,895. However as a result of Social Safety will solely pay out a most of half your earlier month-to-month paycheck, some folks solely obtain just a few hundred {dollars} from Social Safety every month.

Learn extra: Verify Your Social Safety Assertion – And Why You Ought to

How does Social Safety work, and when are you able to begin amassing?

Right here’s how Social Safety works.

Annually you’re employed, you earn one Social Safety “credit score” for each ~$1,500 of revenue you earn, as much as a max of 4 per 12 months. When you earn 40 credit (mainly 10 years of labor), you’ll qualify.

If you strategy retirement, there are three home windows in which you’ll start amassing Social Safety.

- Ages 62-66 aka “early retirement”. You may start amassing Social Safety advantages as early as age 62, however the SSA will dock 0.5% of your advantages for every month earlier than “full retirement” you start amassing.

- Age 67 aka “full retirement”. Everybody born after 1960 has a “full retirement” age of 67, which means that is once you’ll start to obtain 100% of your advantages.

- Ages 68-70 aka “delayed retirement”. The SSA gives you an 8% bonus for yearly previous 67 you delay receiving advantages.

Do it’s important to cease working to gather Social Safety?

No. When you hit 62, you possibly can start amassing Social Safety even should you’re nonetheless amassing a paycheck. Nonetheless, the SSA will withhold a few of your advantages and pay them out later.

In some circumstances, working when you gather Social Safety may even enhance your month-to-month funds earlier than and after your full retirement age (67). This might occur in case your paychecks in your 60s enhance your AIME and thus your total advantages.

The demographic challenges going through Social Safety

Supply: larry1235/Shutterstock.com

Social Safety has labored wonderful for a reasonably very long time, as there have normally been much more employees than there have been retirees. Nonetheless, demographic shifts, together with a falling beginning charge and longer life expectations, imply that the ratio of employees to retirees has gone down.

It’s an issue that’s anticipated to worsen. 17% of the present inhabitants is over 65; the share will enhance to 23% by 2080.

Congress really took steps, again in 1983, to arrange for the tidal wave of retiring Child Boomers. They elevated the payroll tax, and in consequence, Social Safety took in much more in income than it paid out for the next 20 to 30 years. The surplus was invested into non-tradeable Treasury bonds. As of this summer time, these reserves are at the moment value about $2.9 trillion.

Is Social Safety actually disappearing in 2034?

When payroll tax revenues stop to be sufficient to cowl advantages (due to these pesky demographic shifts), the distinction is then taken out of that $2.9 trillion cushion of money. That cushion, nevertheless, is anticipated to be depleted by 2033 or 2034 (estimates differ), which, should you’ll recall, is roughly how lengthy Social Safety is anticipated to have the ability to pay full advantages.

What occurs after that? Nobody’s sure, but it surely’s additionally not as unhealthy because it sounds. Social Safety advantages received’t simply “evaporate” by the point we retire.

At worst, they may get decreased a bit. You and I’ll obtain 75% of what our dad and mom’ technology receives for Social Safety, adjusted for inflation.

However what’s more likely is that the SSA continues to make changes to tax legal guidelines to refill their money reserves in preparation for retiring Millennials. For instance, the utmost annual earnings topic to the Social Safety tax has risen $15,000 in simply three years, from $128,400 in 2018 to $142,800 in 2021.

How a lot are you able to count on from Social Safety?

In a sensible sense, there’s a simple technique to mission how a lot you’ll get in funds on the full retirement age, which is at the moment 67 for folks born after 1960: register for The Social Safety Administration’s Retirement Estimator (it takes about 5 minutes). So long as you’ve collected 40 “work credit” thus qualifying for advantages at retirement, the location can estimate your advantages. Even should you haven’t, it’s a good suggestion to register anyway.

Be sure to have a present bank card quantity helpful (it’s for identification affirmation functions solely—the service is free) and put together to reply some primary monetary questions on who points your high-ticket debt comparable to a mortgage or auto mortgage. When you full the groundwork and register, the location offers you a right away snapshot of your estimated advantages.

I discovered that at age 67, I’ll gather $2,333 a month at my present earnings charge. And if I wait till age 70, that determine grows to nearly $2,800. Now, who is aware of how far that may go a long time from now, but it surely seems like a wholesome place to begin. A minimum of in concept.

Learn extra: Social Safety When You’re Self Employed: What You Want To Know

How Social Safety ought to (or mustn’t) issue into your retirement plans

Supply: Steve Heap/Shutterstock.com

When you’re questioning how a lot Social Safety will add to your paycheck come retirement, hold these three issues to bear in mind:

Depend on the next retirement age

Understand that the present full retirement age is 67. It might go down or extra probably go up by the point we retire. For that cause, it could be greatest to make use of the Social Safety web site to calculate your profit come age 70. There’s no affirmation of this occurring, however a excessive chance stays that the retirement age will creep as much as that stage within the a long time forward.

Keep in mind inflationary intangibles

It’s unattainable to say how effectively Social Safety payouts will hold tempo with future inflation. At the moment, Social Safety is pegged to the Price of Dwelling Adjustment (COLA), and Congress enacted a legislation in 1973 requiring that Social Safety sustain with rising costs.

Social Safety is (probably) right here to remain

Although retirement ages might rise and advantages be minimize in some unexpected method, Social Safety stays an overwhelmingly in style program, as does its shut cousin Medicare. Lawmakers on either side have each incentive to save lots of Social Safety if it will get in bother, and received’t contact the core of it if the coffers stay robust.

Social Safety is not a alternative for saving

There’s an outdated saying that you need to at all times “hope for the perfect, and plan for the worst.”

Let’s all hope that Social Safety will get stronger and stronger over the following few a long time, even to the purpose that you simply and I can retire off of Social Safety alone in our early 60s.

Let’s hope for that.

Let’s plan for Social Safety to utterly evaporate by the point we retire.

To be clear, neither situation is probably going. Social Safety will almost certainly nonetheless be round in 40 years in some type or one other. Your month-to-month examine could also be for $700 or $3,700 in at present’s {dollars}, or wherever in between.

However planning for the worst, on this case, and in most of your monetary forecasting, will depart you higher ready for the long run.

Learn extra: How A lot Do You Want To Have Saved For Retirement? (At Age 30, 40, 50, 60, And Even 65)

Abstract

The way forward for Social Safety isn’t as bleak as our technology thinks. The Social Safety Administration has already begun adjusting tax legal guidelines to refill reserves prematurely of retiring Millennials. We’ll get one thing from Social Safety; it most likely received’t be sufficient to dwell off of, but it surely’ll be greater than most expect.

That being mentioned, you’re higher off planning for retirement as if Social Safety received’t exist. Deal with it as bonus, supplemental revenue to your financial savings, investments, and retirement accounts.